What You Need to Know Prior To Getting a Secured Credit Card Singapore

What You Need to Know Prior To Getting a Secured Credit Card Singapore

Blog Article

Exploring Options: Can Former Bankrupts Secure Credit Rating Cards Adhering To Discharge?

Browsing the economic landscape post-bankruptcy can be a difficult task for people aiming to restore their debt. One typical inquiry that arises is whether previous bankrupts can efficiently obtain bank card after their discharge. The response to this inquiry includes a complex exploration of different variables, from charge card choices customized to this group to the impact of past financial decisions on future creditworthiness. By recognizing the details of this procedure, people can make informed decisions that might pave the means for a much more safe financial future.

Understanding Charge Card Options

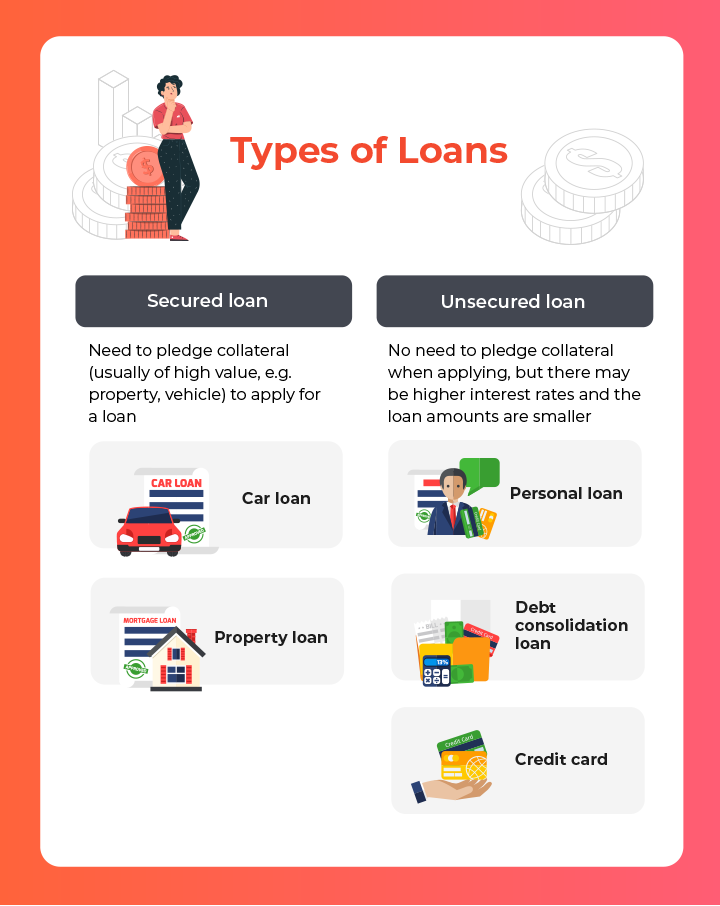

Navigating the world of bank card choices requires a keen understanding of the differing terms and features available to customers. When considering bank card post-bankruptcy, individuals should thoroughly assess their demands and monetary situation to select one of the most appropriate option - secured credit card singapore. Secured bank card, for circumstances, require a cash money deposit as collateral, making them a viable option for those looking to restore their credit rating background. On the other hand, unprotected bank card do not require a down payment however might include higher rate of interest and fees.

Furthermore, people need to pay close interest to the annual percentage price (APR), elegance duration, annual fees, and benefits programs used by different credit rating cards. By comprehensively assessing these factors, individuals can make informed choices when picking a credit history card that aligns with their financial objectives and scenarios.

Variables Affecting Approval

When applying for charge card post-bankruptcy, recognizing the aspects that affect approval is important for people looking for to rebuild their economic standing. One important factor is the candidate's credit report. Following an insolvency, credit report scores commonly take a hit, making it more difficult to get approved for conventional bank card. However, some providers provide safeguarded bank card that need a down payment, which can be a more possible choice post-bankruptcy. One more considerable aspect is the applicant's earnings and work status. Lenders desire to make sure that individuals have a steady revenue to make prompt payments. Furthermore, the size of time because the personal bankruptcy discharge plays a role read more in authorization. The longer the duration since visit this site right here the insolvency, the greater the opportunities of approval. Showing accountable monetary habits post-bankruptcy, such as paying costs promptly and maintaining debt utilization reduced, can likewise favorably influence credit history card authorization. Understanding these variables and taking steps to enhance them can increase the possibility of securing a charge card post-bankruptcy.

Safe Vs. Unsecured Cards

Protected debt cards require a money down payment as collateral, typically equivalent to the credit rating restriction extended by the company. These cards normally offer greater credit rating limitations and lower rate of interest prices for people with excellent credit report ratings. Eventually, the selection between secured and unsecured credit history cards depends on the person's monetary scenario and credit goals.

Structure Credit Report Responsibly

To efficiently rebuild credit history post-bankruptcy, establishing a pattern of responsible credit rating utilization is necessary. Furthermore, keeping credit rating card equilibriums reduced relative to the credit rating restriction can favorably impact credit rating ratings.

Another strategy for developing credit score sensibly is to keep an eye on debt reports on a regular basis. By evaluating credit scores reports for mistakes or indications of identification theft, individuals can deal with problems without delay and maintain the accuracy of their credit report background.

Enjoying Long-Term Perks

Having actually developed a foundation of accountable debt management post-bankruptcy, people can currently concentrate on leveraging their boosted credit reliability for long-term monetary advantages. By constantly making on-time repayments, maintaining credit usage low, and monitoring their credit records for precision, previous bankrupts can gradually restore their credit history. As their credit rating enhance, they may become qualified for better bank card uses with lower rates of interest and greater credit history limits.

Reaping long-term advantages from improved creditworthiness prolongs past simply credit rating cards. Additionally, a positive credit profile can boost work potential customers, as some companies may examine credit report reports as part of the working with process.

Verdict

To conclude, previous bankrupt people might have difficulty protecting credit history cards adhering to discharge, but there are alternatives available to help restore credit history. Comprehending the various kinds of bank card, factors influencing approval, and the importance of responsible debt card use can help people in this circumstance. By choosing the ideal card and using it responsibly, previous bankrupts can progressively enhance their credit history and gain the long-term advantages of having accessibility to credit score.

Showing accountable financial habits post-bankruptcy, such as paying costs on time find and maintaining credit scores use reduced, can likewise favorably influence credit report card authorization. Additionally, keeping credit card balances low family member to the credit score limitation can positively affect credit rating ratings. By constantly making on-time repayments, keeping debt usage low, and monitoring their credit score records for accuracy, previous bankrupts can slowly rebuild their credit rating scores. As their credit rating ratings boost, they may come to be eligible for far better credit score card uses with lower rate of interest rates and greater credit scores restrictions.

Comprehending the various kinds of credit scores cards, factors influencing approval, and the value of responsible credit score card usage can assist people in this situation. secured credit card singapore.

Report this page